(Alternative Title: The Three “P”s – Point of Service, Platform, Partnership)

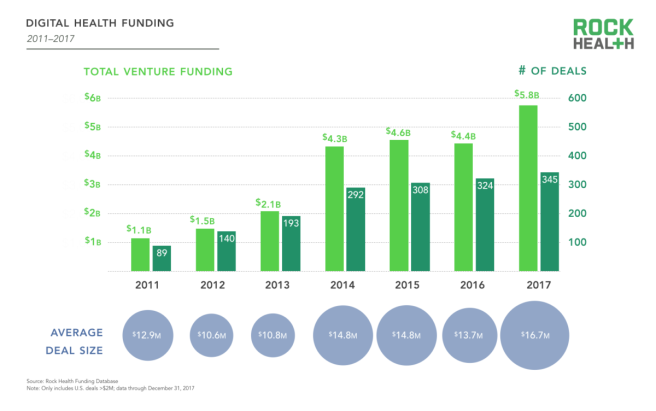

Over the last few years, the digital health space has seen a lot of new entrants, a lot of deals, and a lot of money invested. The recently released report from Rock Health summarizes this nicely.

(Graph from Rock Health’s “2017 Year End Funding Report: The end of the beginning of digital health” report).

(Graph from Rock Health’s “2017 Year End Funding Report: The end of the beginning of digital health” report).

This is great news for those of us in the space – entrepreneurs keep coming up with ideas to help impact the health care space. Investors have money and an appetite to invest. Buyers of the solutions still have an appetite to try new products and services.

Many of these vendors offer point of service solutions – meaning the product or service meets a specific need vs. a broad array of needs. An example of this would be a weight loss tool or a diabetes management service. It serves a singular purpose.

By comparison, platform solutions are designed to provide a number of services. A wellness platform could cover weight loss, exercise, nutrition, challenges, rewards, smoking cessation and other services. A disease management platform may tackle diseases such as asthma, diabetes, congestive heart failure, coronary artery disease, depression and others.

I’ve not counted the number of recent entrants that offer point of service solutions vs. those that offer a platform solution, but based upon my own view of the landscape, we’re seeing more point of service solutions.

Is this a bad thing? Not necessarily, but it does pose a challenge to the customer.

Lets assume that a startup vendor is offering a diabetes management solution to self-funded employers. The customer in this case is the self-funded employer. And lets assume that the employer may already have a disease management vendor handling diabetes as well as other conditions. This disease management program may be something the employer purchased on their own or it could be part of their medical insurance carrier’s offerings – meaning it’s being paid for already.

But if the point of service solution is a better option (perhaps due to the fees at risk, or the solutions impact on the employees with the disease), then the employer is stuck paying more money for the startup vendor in hopes that the medical savings will offset their spend on the solution.

Then take into account that there are a multitude of point of service solutions in the diabetes management space. The equation gets more complicated. Now consider more point of service solutions are bringing other disease specific solutions to the market.

The vendor landscape for the customer becomes quite crowded and blurry.

Up to now, I’ve discussed point of service solutions and platform solutions. How does the last “P” – partnership – fit into this crowded picture?

When I speak to early stage digital health companies offering a point of service solution, we inevitably discuss who their “customer” is. Is it the health plan? A hospital? A self-funded employer? The employer’s benefits advisor? I suggest a new customer – an existing point of service vendor or platform vendor.

What is often overlooked, and what I predict will happen more in 2018 and beyond, is the partnership model. Organizations that offer a platform solution will reach out to point of service solutions (or vice versa) to bring a best-in-class platform offering comprised of point of service solutions. Or two complementary vendors will announce a partnership like the recently announced Solera Health and WellDoc partnership or the Springbuck and Healthjoy partnership. The self-funded employer will benefit from a consolidation of strong point of service solutions in a one-vendor platform thus making it easier for the benefits team at the employer to manage the vendor while deriving maximum benefit for the services being offered.

I attend a lot of events with startups and VCs and typically the speakers are asked for a prediction for the future. With this in mind, I’m predicting 2018 (and maybe 2019) to be the year of the partnership.

Let’s see how many of these things pop up this year…

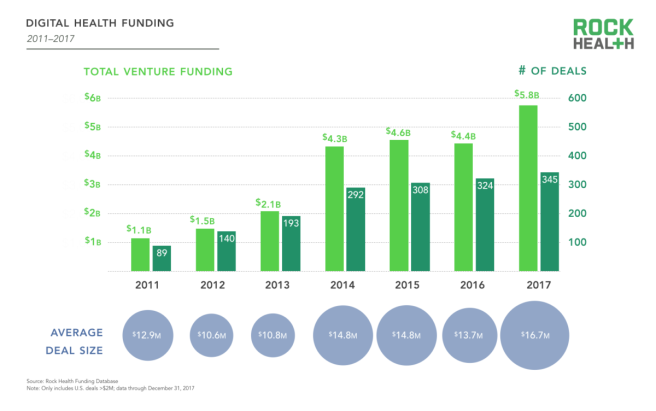

(Graph from Rock Health’s “2017 Year End Funding Report: The end of the beginning of digital health” report).

(Graph from Rock Health’s “2017 Year End Funding Report: The end of the beginning of digital health” report).